Trade Stocks and Indices

Stocks are a fabulous category of financial assets, without a doubt, one of the greatest tools ever invented for building wealth.

What is Stocks & Indices trading?

The definition of a stock is simple, the stock is a share in the ownership of a company. Stock represents a claim on the company’s assets and earnings. Whether you say shares, equity, or stocks, it all means the same thing. If you own a share, you own a slice of pie, cut out of a bigger pie.

The marketplace determines share prices. While the supply and demand meet in the market, there is no defined equation that permits investors know exactly how share prices will behave. However, there are some factors which cause the move of the stocks up and down.

> Demand and supply

Demand and supply in the market define the price of a particular stock. When demand for shares is higher than supply, meaning that there are more buyers than sellers, the price goes up. On the other hand, when demand is less than supply, meaning that buyers are less than sellers, the price decreases.

> Interest rates

If the interest rates are low, demand for funds is higher and subsequently demand for shares goes up. On the other hand, high interest decreases the demand for funds and the demand for shares goes down.

> Investors

Market players have an impact on share prices. With more bulls than bears, the prices increase. With more bears than bulls, share prices decline.

> Dividends

Dividends indicate share price movements. When companies make announcements of dividend, the share prices of a certain company is likely to increase. Let’s emphasize that if the dividend rate announced is lower than the investors’ expectations, share prices decline. If they are higher than expected, share prices increase.

Today’s corporate giant likely had its start as a small private entity launched by a visionary founder a few decades ago. Think of Jack Ma incubating Alibaba Group Holding Limited (BABA) from his apartment in Hangzhou, China, in 1999, or Mark Zuckerberg founding the earliest version of Facebook, Inc. (FB) from his Harvard University dorm room in 2004. Technology giants like these have become among the biggest companies in the world within a couple of decades.

However, growing at such a frenetic pace requires access to a massive amount of capital. In order to make the transition from an idea germinating in an entrepreneur’s brain to an operating company, he or she needs to lease an office or factory, hire employees, buy equipment and raw materials, and put in place a sales and distribution network, among other things. These resources require significant amounts of capital, depending on the scale and scope of the business startup.

HOW Indices trading works

First, let’s look at the ways to calculate the value of a stock index. There are many, but the most famous ones are:

The Market Capitalization Weighted Method

The stocks in the index are weighted using the market capitalization of the individual companies. The company with the highest weight in the index will generally lead the most of index movements. The S&P 500 is an example of a market capitalization weighted index.

The Price Weighted Method

The stocks in the index are weighted by the price of the stock. This means that even a company might have a small market capitalization, if the stock’s price is higher compared to the other companies, then this small market capitalization company with the highest stock price will lead the behaviour of the index. The DJIA is an index weighted using the price-weighted method.

The Equal Weighted Method

The return of each stock in the index is calculated and then summed and divided by the amount of stocks in the index.

The Fundamental Weighted Method

The index is constructed using fundamental facts like price to earnings ratios, earnings, book values and others.

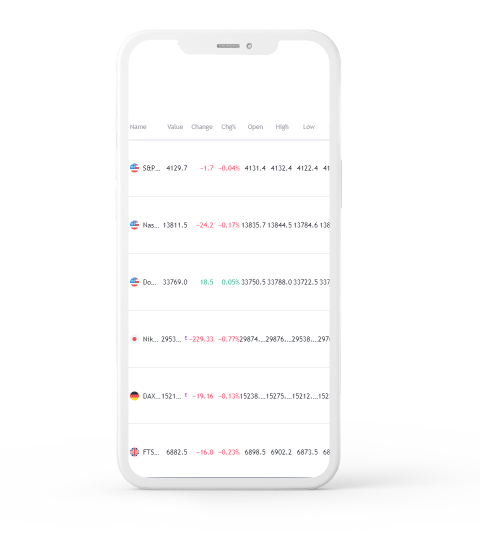

Stocks & Indices Prices

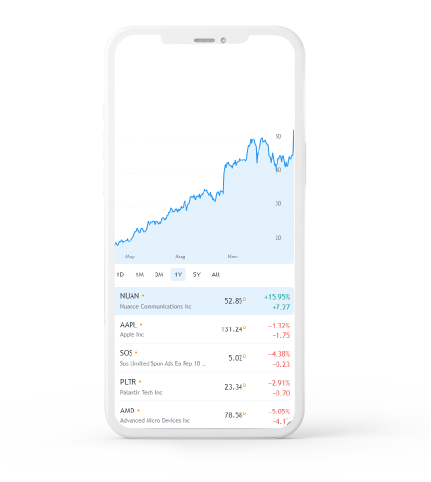

HOW Stocks trading works

“The majority of stocks are traded on exchanges, which serves as a crossing road for buyers and sellers to decide on a price. Some stock exchanges are physical locations where both parties meet and decide on a price. You have crossed at least one picture of a trading floor, in which traders are wildly throwing their arms up, waving, yelling, and signaling to each other. The other type of stock exchange is virtual, made of a network of computers where traders, the platforms are made electronically.

The aim of a stock market is to make stock trading easier for traders. First, let’s make clear that there are two markets: the primary and secondary markets. The primary market is where securities are created. It is the market where companies sell new stocks to the public for the first time.

The secondary market is where traders buy and sell securities they already own. It is what most people think as the “stock market”.

A market index is a theoretical portfolio of investment holdings that shows a segment of the financial market. The value of the index is calculated from the prices of the underlying holdings. The value might be calculated based on market-cap weighting, revenue-weighting, float-weighting, and fundamental-weighting. Weighting is a method of adjusting the individual impact of items in an index.

The three most popular stock indexes for tracking the performance of the U.S. market are the Dow Jones, S&P 500 and Nasdaq Composite.

> Diversify your portfolio

Be more exposed to the financial markets world.

> Raise your trading potential

Indices allow you to trade on both rising and falling markets with chances of making money in both cases.

> Take the best out of the market movement

Trade on price movements caused from corporate news and world events.

> Broaden your trading chances

Tap into the opportunity of a market or sector, without stock-specific risks.

What affects the value of stocks?

Macro-economic factors such as interest rates, inflation, unemployment and economic growth often move stock markets. Stock markets are always rooting for more economic growth, because it usually means more profits for companies, and more profits tend to grow the value of stocks. Declining interest rates often send markets higher, because they are seen as a harbinger of economic growth. High inflation has the opposite effect, because it signals that interest rates will be rising in the immediate or near future, thus slowing economic growth.

A belief by investors that control of the government by one party or the other will hurt or benefit them can move the market as whole. This is especially true in times of intense domestic turmoil. Significant developments abroad also can affect U.S. markets. An election involving one of our major trading partners that brings to power an avowedly hostile government can push markets lower. However, the converse is also true. The election of a friendly foreign government can move markets higher.

Natural or man-made disasters with economic consequences also affect stock markets. If an earthquake happens in a bustling city where there’s lots of economic activity, markets will move down as investors fear a negative impact on economic growth. Similarly, if there’s a disaster at a man-made facility of economic importance, such as an oil refinery blowing up, it can put downward pressure on stock prices.

At the end of the day, swings in the stock market are caused by human beings. There are boom periods in a rising market when everyone wants to buy. Alternatively, there are also periods of panic when almost every investor is scrambling to sell.

“

Learn about more assets

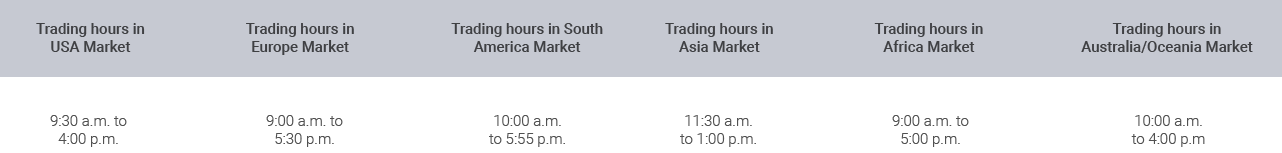

TRADE STOCKS Market availability