Trade Bitcoin and Altcoins

Digital currencies have seen unexpected popularity since they first came to light in 2009. There are now over two thousand in existence. The most popular ones include Bitcoin, Ethereum, Ripple and Litecoin.

What is BITCOIN & ALTCOINS trading?

A digital currency is a payment method that can be exchanged online for goods and services. There are several companies which have issued their currencies, they are also called tokens, and can be used for the goods or services that the company provides. You will have to exchange fiat currency for the cryptocurrency to access the goods or services.

It is a digital asset based on a network that is spread across a large number of computers. As it is easily understood that this is a decentralized structure that allows them to exist away from governments and central authorities.

What affects the Cryptocurrency market?

Speculation is a well-known influence on digital currencies prices. We all saw the collapse of Bitcoin’s price in 2018, mentioning the big shot of 2017 on a $20,000, going down to $1,000 in 2018. Both experienced and inexperienced traders can go long expecting the price to continue going up.

Digital currencies have shown us a high sensitivity towards announcements. The kind of news that can cause changes in the price of Bitcoin starts from the CEO of JPMorgan Chase calling Bitcoin a ‘fraud’ to characteristics of the networks being hacked. There are of course economic and political events causing movements in fiat currencies that can lead traders to lose faith in the traditional currencies and turn to cryptos, pushing up the price.

Since it is widely known that Digital currencies are decentralized creations, there are lots of disagreements about the legitimacy of currency status, or even whether they should be illegal. China is one of the countries that put restrictions, like blocking websites that offer cryptocurrency trading services. This caused a 15% fall in Bitcoin and 20% plunge for Ether. During January 2018, Bitcoin’s price was hit by new South Korean legislation requiring Bitcoin traders to reveal their identity.

As more and more digital currencies enter the market, the price of the current ones tend to go down (even slowly).

Top digital currencies traded worldwide

Bitcoin is without doubt the most famous cryptocurrency nowadays. Designed by Satoshi Nakamoto, an anonymous person, in 2008. Bitcoin can be used as a medium of exchange. For example, companies in travel, gifts, jewellers sectors are accepting Bitcoin as payment through anonymous online transactions. However, there are several companies that accept it as currency, others avoid it because of dramatic price swings. In January 2017, Bitcoin price rose sharply $1,151. In December 2017, its price went to the highest of all time $19,783. By February 2018 it dropped to below $7,000, in a matter of days it went up to $11,000, before going down to $4,000. Subsequently, one of the key characteristics of Bitcoin that traders should understand is its potential for extreme volatility.

Ripple is a cryptocurrency released in 2012, that runs on the blockchain network RippleNet. Its user base comprises more than 100 banks and payment providers which use the network for international procedures. Ripple can be exchanged for any currency and serves as mediator between currencies that are relatively expensive to exchange directly via traditional methods. It can also be used for fast international transactions, with an average transaction time of four seconds.

Ether was developed in 2012, by Vitalik Buterin, a Toronto- based programmer and backed by an initial $18 million crowdfund. While Bitcoin was designed to be a digital currency, Ethereum is a more general implementation of blockchain technology. A well- known attribute of Ethereum network is that it gives users the chance to create independent apps, known as ‘dapps’ and smart contracts.

Litecoin was released in October 2011 by ex-Google employee Charlie Lee. Launched with the intention of being a cheaper version of Bitcoin for everyday purposes, Litecoin was formed in a ‘hard fork’ (split) of the Bitcoin Core client.

WHY trading digital currencies with DeltaChainX?

“Digital currencies are able to be traded 24/7 since there are no other parties controlling them. You can practically trade any time during the day/week, you just need to pick the right moment. Digital currency market is not officially accepted by governments and central banks, even though they are doing well without their support. Some countries have allowed bitcoin for many services, some others have banned it.

Even though digital currencies are traded around the clock, some of the moments are busier than the other periods of the day. The most involved countries are the USA, Russia, and the UK. They have the largest crypto trading volumes. It is not a strange thing that big moves on Bitcoin or other digital coins happen during Sunday midnight, which might penalize traders in different timezones.

Who rules Digital Currency World?

Users, they might be an individual or a legal entity who obtains coins to purchase real or virtual goods or services.

Miners, they make the transactions valid by solving a ‘cryptographic puzzle’. They support the network by using computing power to validate transactions and are rewarded with new coins. They raise the supply.

Exchanges, they help digital currency holders to convert their cryptos into fiat currencies and vise-versa.

Trading platforms are marketplaces that bring together different digital currency users that are either looking to buy or sell coins, providing them with a platform on which they can directly trade with each other.

E- wallets are used to hold, store and transfer digital coins among the digital currency users.

Digital Currency Prices

HOW Bitcoin & Altcoins trading works

“To understand better bitcoin, it is needed to separate it into two components. On the one hand, there is bitcoin- the- token, a snippet of code that represents ownership of a digital concept. On the other hand, there is bitcoin- the -protocol, a distributed network that maintains a ledger of balances of bitcoin-the-token. Both are referred to as “bitcoin.”

In what ways is it different from traditional currencies?

If both parties are expecting it, then, Bitcoin can be used to pay things electronically. But it differs from printed currencies in many different ways:

Decentralization

Bitcoin’s most important characteristic is that it is decentralized. No single institution controls the bitcoin network. It is maintained by a group of volunteer coders and run by an open network of dedicated computers spread around the world.

Limited supply

A small number of new bitcoins trickle out every hour and will continue to do so at a diminishing rate until a maximum of 21 million has been reached. This makes bitcoin more attractive as an asset – in theory if demand grows and the supply remains the same, the value will increase.

Pseudonymity

In practice, each user is identified by the address of his or her wallet. Transactions can, with some effort, be tracked this way. Also, law enforcement has developed methods to identify users if necessary.

Immutability

If a transaction is recorded on the network, and if more than an hour has passed, it is impossible to modify. While this may disquiet some, it does mean that any transaction on the bitcoin network cannot be tampered with.

Can Bitcoin be converted to cash?

There are several possible ways to convert bitcoin to cash and ultimately move it to a bank account: Sell bitcoin on a cryptocurrency exchange, such as Coinbase or Kraken. This is the easiest method if you want to sell bitcoin and withdraw the resulting cash directly to a bank account. Use a bitcoin ATM.

Learn about more assets

TRADE DIGITAL CURRENCIES

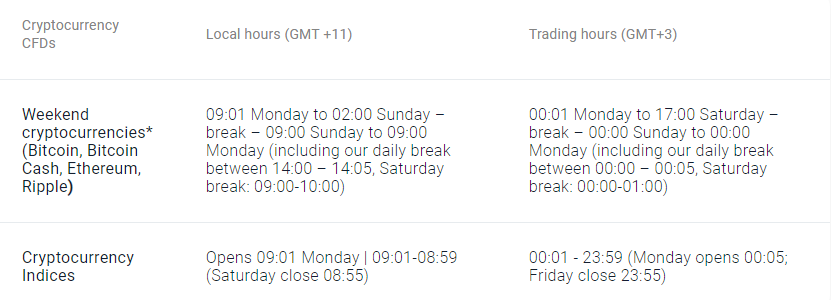

Market availability