Trade commodities

Log in in the most popular commodity categories and diversify your portfolio with safe haven assets.

What is COMMODITY trading?

We can consider two major types of commodities: soft commodities- agricultural products such as corn, wheat, coffee, cocoa, sugar, and soybean; livestock also. Hard commodities – natural resources that need to be mined or processed before using them, such as crude oil, silver, gold, rubber. Since old times, commodities have served a crucial role in shaping the global economy and have affected the lifestyle of people. History is replete with examples of how a shortage of critical commodities sparked huge public outcry and social unrest. Of late, the world community is concerned over the environmental and health costs of production and consumption of certain commodities and impact on society.

When an economy is growing, industrialize and urbanize, people typically consume larger amounts of commodities – specifically industrial metals like steel, and energy as well. However, as economies become stronger, you will typically see smaller increases in commodity demand for a particular rise in income. But, the type of commodities consumed changes – as economies become stronger, people typically consume more protein-based foods, which in turn increases demand for livestock and the crops used to feed them.

A commodity price is fundamentally defined by the cost of producing this commodity. Commodity production costs include raw materials, research and development, insurance, licensing commissions, taxes and every other cost attached by real-world commodity businesses. When it comes to technology, it may cut the costs of production, since it might ask for fewer resources to produce it.

Too much of a weather type will damage a specific kind of agriculture. Hurricane-force winds in the US can obligate oil producers to shut down. The weather can affect other commodities too. Hurricane-force winds in the US Gulf can force offshore oil producers to shut down. Low water levels in fields can make it difficult for agriculture to grow.

If there are low-interest rates, usually businesses and consumers borrow money to invest and consume. This will result in an increase in demand for commodities. Most internationally traded commodities are bought and sold in US dollars. So, changes in US interest rates are transmitted through the price of these commodities.

WHY trading commoditites with DeltaChainX?

Commodities might be related to food, energy or metals, and they are still a very important part of our daily lives and financial markets. If you possess a car, you have noticed how you were impacted by rising crude oil prices. The impact of a drought on the supply of rice may influence people’s meals. Like other assets, commodities are also an important way to diversify a portfolio beyond traditional assets- even when it comes to long term or as a safe place to invest some cash during the unusual volatility of the stock market, as commodities and stocks move in opposite directions. It was a kind of tradition that investors who did not have enough time, money and expertise were not very welcomed to the commodities market. Nowadays, there are several methods which facilitate participation in commodity trading of all kinds of traders.

> Grab influential markets

Take the power of trading hot metals, energy, and agricultural commodities.

> Boost your trading chances

Commodities allow you to trade in bullish and bearish markets.

> Expand your trading possibilities

Speculate in new markets and hedge against inflation

> There are zero commission

No commission either fees for trading commodities, enjoy margins from just 1 %.

Trading Crude Oil

Oil price depends on a lot of geopolitical factors and also reflects market participants’ beliefs. Not only individual clients but countries and big companies can all be considered players in the oil market. To be clearer, airline corporates trade oil to decrease their risk for the fuel price increase, meanwhile individual traders perform in order to make money from price movements. Oil prices are conditioned by the same factors like the exchange rates of currencies, i.e. political developments, financial events, and even weather.

Trading Gold

DeltaChainX Company advice you to Log in with one of the safest and effective instruments in financial markets. Since today is easy for everyone interested to have access to the global gold market and invest their capital in this asset. Gold is a profitable deposit, and it is more profitable during crises when other investments cannot yield the same result.

The biggest gold markets are located in Zurich, Hong- Kong, London, New York, and Dubai. Few market participants are accepted and very strict requirements are applied. Usually, they are big banks and specialized companies, which are well known and have credit standing. There is possible to have a quite wide number of transactions, no taxes or customs control is applied. The deals are not rigidly regulated: the rules are made by market participants themselves.

Commodity prices

HOW Commodity trading works

“Precious metals have been valued for centuries, and hold a unique place in the current-day market. Their value will not be going away any time soon and may be especially beneficial as a portfolio diversifier for traders who prefer long-term trading strategies. However, the trick to making money buying and selling precious metals is knowing and understanding both the risks and rewards involved. The volatility of the precious metal market should not be underestimated, but this should also not scare away traders. In this volatility, the ability to make or break a fortune is found.

When it comes to the commodities market, it works just like the other markets. It is a physical or virtual space, where one can buy, sell or trade a certain commodity or a basket of commodities at current or future price. Trading commodities can be done through futures contracts also. A futures contract is an agreement between the buyer and the seller, wherein the buyer promises to pay the agreed-upon sum at the moment of the transaction when the seller delivers the commodity at a pre-decided date in the future.

Top five oil-generating countries:

The United States is the top oil-producing country in the world, with an average of 17.87 million barrels/day, which accounts for 18% of the world’s production.

The Kingdom of Saudi Arabia contributes 12.42 million b/d, representing 12% of the world’s total production.

Russia has fallen in the ranks, it remains one of the world’s top oil producers, with an average of 11.4 million b/d in 2018, accounting for 11% of total world production.

Canada holds the fifth spot among the world’s leading oil producers, with an average production of 5.27 million b/d in 2018, accounting for 5% of global production.

China produced an average of 4.82 million b/d of oil in 2018, which accounts for 5% of the world’s production. China is a net importer of oil, as the country consumed an average of 12.79 million b/d last year.

Learn about more assets

TRADE DIGITAL CURRENCIES

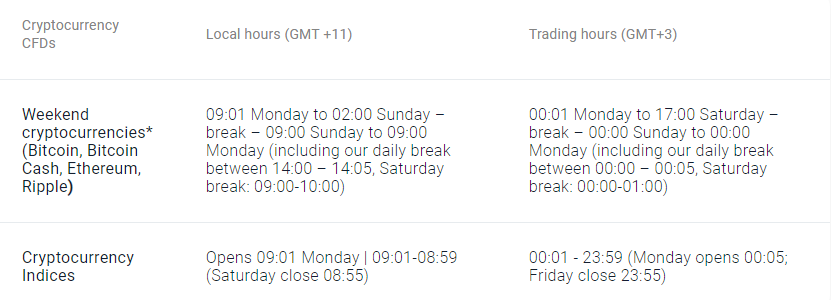

Market availability